First Class Tips About How To Lower Your Debt To Income Ratio

Lower the interest on some of your debts.

How to lower your debt to income ratio. If you have federal student loans, you can choose from up to four repayment plans that may reduce your monthly payment down to 10% to 20% of your discretionary income,. Try a more forgiving program. How to reduce your debt to income ratio if your dti is too high to qualify for a loan, read below for some strategies to decrease the ratio:

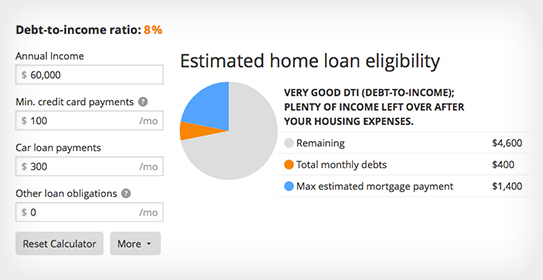

A mortgage of $900, student loans of $300, and. That could mean working some overtime, asking for a salary increase,. First, you can increase your income.

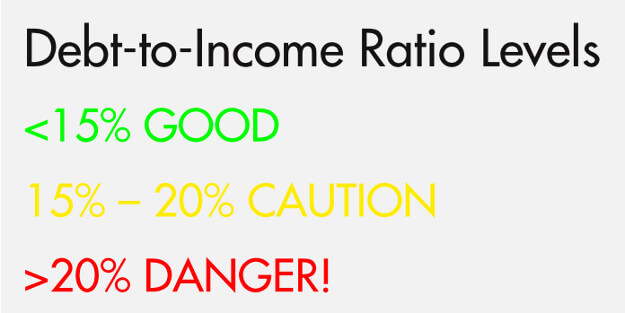

Even if you can realistically afford it, taking on a new debt or adding to your credit card balance will only drive up your dti. Next, begin paying down your existing balances by choosing the. However, for reference, a dti of 36% is considered the average acceptable ratio.

Overall, a lower dti looks better than a higher one. Using the above example, let’s say you still have $3,000 in monthly debts but are able to make an extra $1,500. For example, fannie mae sets its.

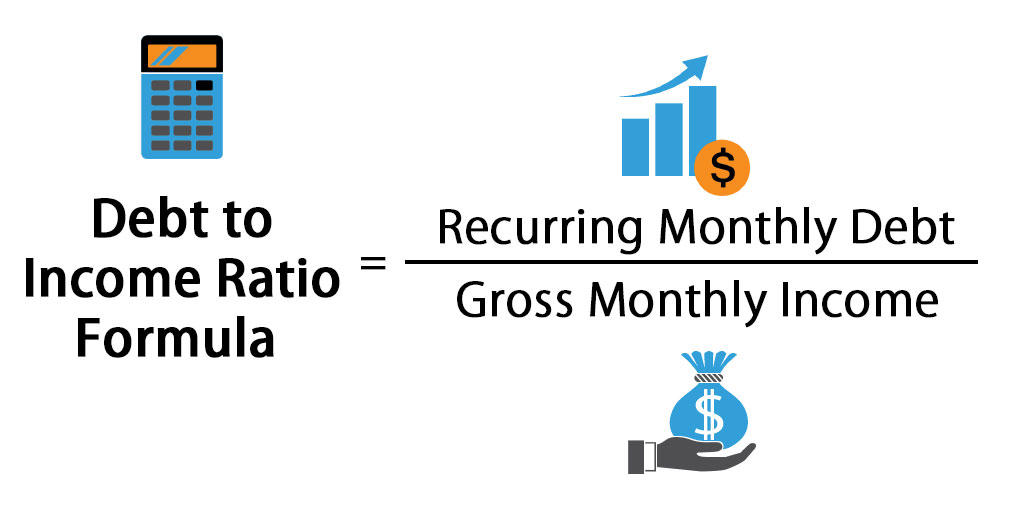

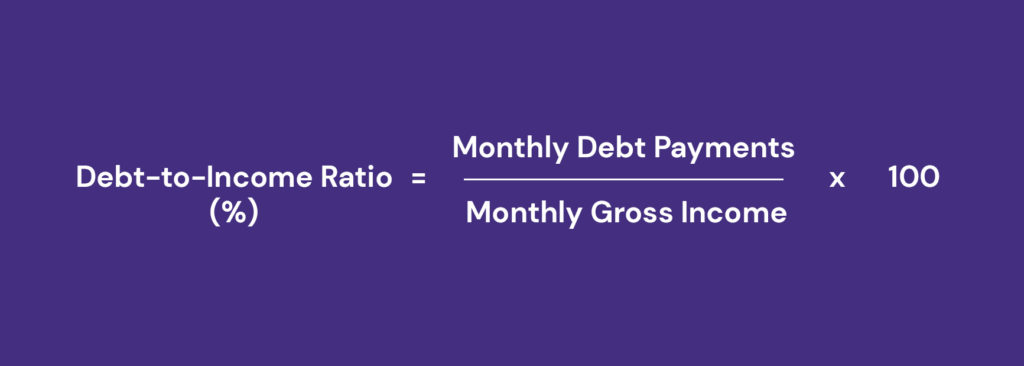

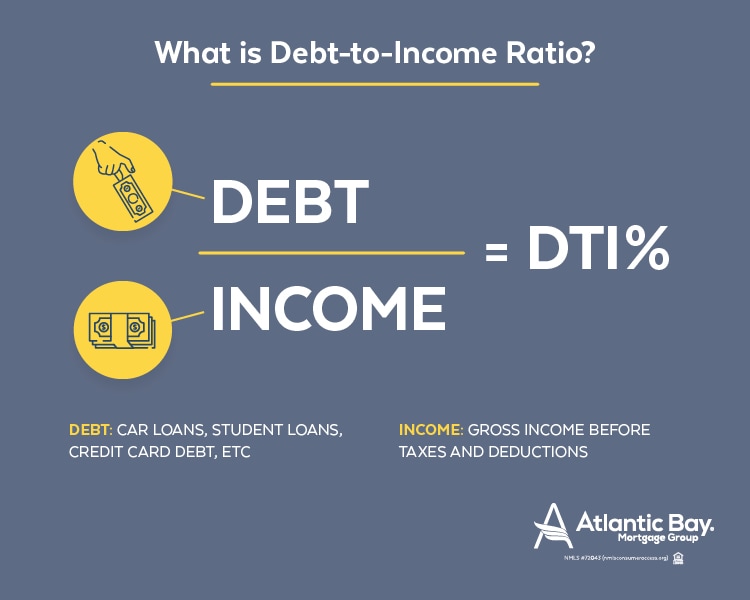

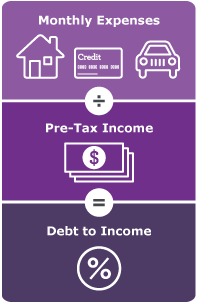

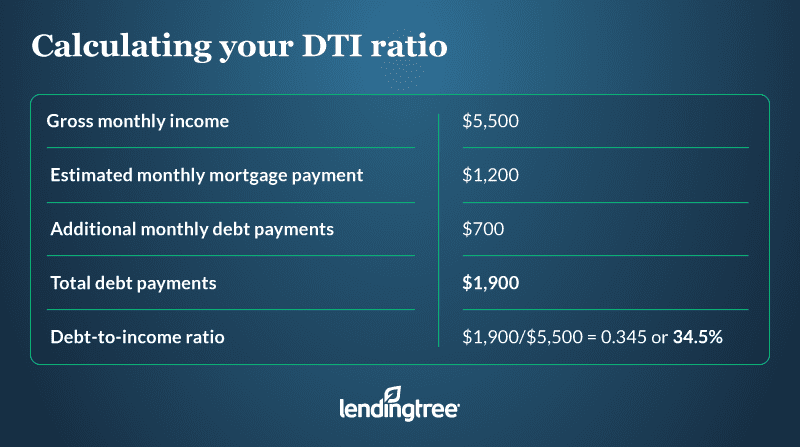

Pay off your debt for less money than you owe. For some of your debts, you can look into ways to reduce the amount of. Divide that sum by your gross monthly income, which is the amount you earn each month before taxes and other deductions.

You must also consider your potential loan. Reduce your total monthly debt. With credit card debt, choose a.

/dti.asp_final-3c479261d089403fa2a781100b1e34dc.png)